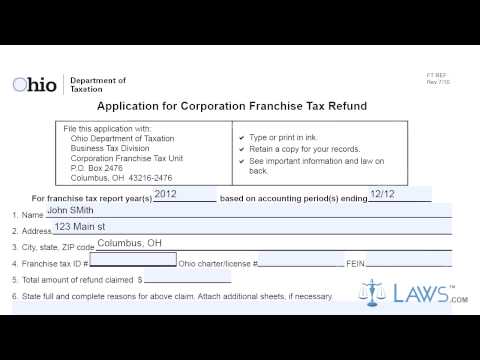

Laws calm legal forms guide form ftre f application for corporation franchise tax refund. Corporations operating in Ohio use a form RTR EF if they wish to apply for a franchise tax refund on the basis of overpayment, as a result of an erroneous assessment, failure to claim a credit due, or other errors. This document is found on the website of the Ohio Department of Taxation. Step one and two: The year or years for which you are seeking a franchise tax refund. Step two: Enter the end date of the account period or periods for which you are seeking a refund. Step three: On line one, enter your corporation name. Step four: On line two, enter your corporation address. Step five: On line three, enter your corporation city, state, and zip code. Step six: On line four, enter your franchise tax identification number in the first blank. Step seven: In the second blank, enter your Ohio charter or license number. Step eight: In the third blank, enter your federal identification employer number. Step nine: On line five, enter the total amount of the refund you are seeking. Step ten: On line six, provide a written explanation of the basis of your claim for a refund. Attach additional sheets as necessary. Step eleven: In the chart in section seven, enter the amount and date of every payment for which you are seeking a refund. Step twelve: The person responsible for filing this application should be the taxpayer or their authorized representative. Provide your name, title, email address, signature, date, and phone number. Prthe name, address, title, phone and fax numbers, and email address of a contact person if different. To watch more videos, please make sure to visit Laws Calm.

Award-winning PDF software

30 rto delhi download Form: What You Should Know

FORM — 30. {See Rule 55(8)}. Application Form for Intimation and Transfer. Of Ownership of a Vehicle. TO BE FILED ON FORM NO.31 : [This form is dated on July 16, 2018.] FORM 31 — Applications for Intimation and Transfer of Ownership of a Vehicle. FORM 31 — [See Rule 55 (2) and (3)]. Transfer of Ownership of a Motor Vehicle. PART I-For the use of transferor. FORM 31 — Did.gov.in FORM 31. (See Rule 55(2) and (3)). APPLICATION FOR INTIMATION AND TRANSFER OF OWNERSHIP OF A MOTOR VEHICLE. (To be made in duplicate if the Vehicle is form 31 FORM 31 — FORM 31. {See Rule 55(2) and (3)}. Application for INTIMATION AND TRANSFER OF OWNERSHIP OF A MOTOR VEHICLE. (To be made in duplicate if the Vehicle is form 31. {See Rule 55 (2) and (3)}. Transfer of Ownership of a Motor Vehicle. Part— 1 (FOR USE OF TRANSFERRED OR APPLICANTS): FORM 31. {See Rule 55(2) and (3)}. FORM 31. {See Rule 55(2) and (3)}. FORM 31. {See Rule 55(2) and (3)}. FOR USE OF TRANSFERRED OR APPLICANI.TS OF OWNERSHIP OF A MOTOR VEHICLE [Form 31] For the Use of Transferor AND Applicants of Forms Download — Delhi Transport Department FORM 31 — Did.gov.in FORM 31. {See Rule 55(2) and (3)}. FORM 35 — Application for Intimation and Transfer of Ownership of Motor Vehicle [Request to see list of vehicles for which permission has been issued}. FORM 35. {See Rule 55(8) and (9)). Applicant will furnish List of Vehicle(s) for which permission has been issued in form 35 to the Transferor to be on hand at time of Intimation and Transfer of Ownership. Form 35.— To be made in duplicate if the Vehicle is to be transferred in FORM 35. {See Rule 55 (8) and (9)}. Form 35. {See Rule 55 (8) and (9)}.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form No 29 and 30, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form No 29 and 30 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form No 29 and 30 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form No 29 and 30 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 30 rto delhi download